Dalton Council Now Intends To Adopt Rollback Millage Rate

Tuesday, November 12th, 2024

Tuesday, November 12th, 2024

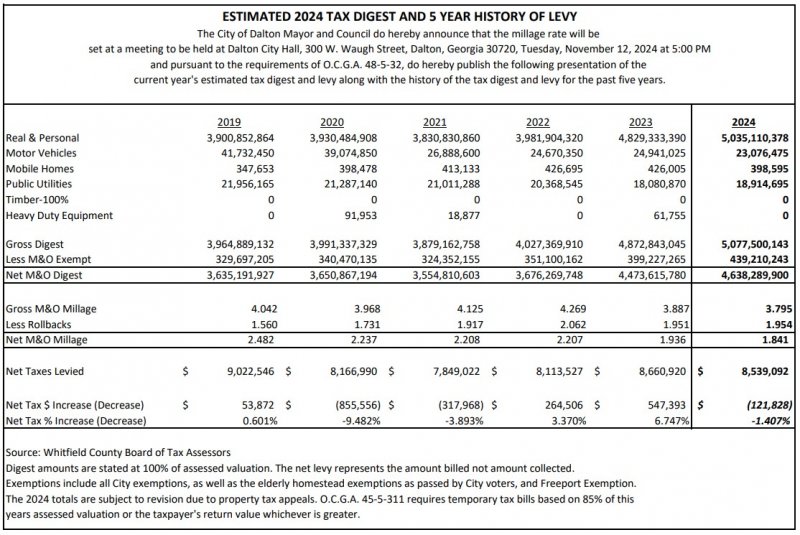

The Dalton Mayor and Council will meet Tuesday evening at 5:00 pm to set the millage rate for 2024 property taxes. After initially considering holding the millage rate at its 2023 level which would have created a 5.1% property tax increase, the Mayor and Council now intend to consider a vote to adopt the full rollback rate of 1.841 mills. By adopting the rollback rate, the City of Dalton will not increase property taxes.

The Council initially considered holding the millage rate at its 2023 level due to a lack of confidence in the temporary tax digest in Whitfield County that may or may not reflect fair market values. After issuance of an initial digest, the tax commissioner refused to certify the tax digest. The Whitfield County Superior Court has issued a collection order based on the temporary tax digest. Due to the lack of confidence in the temporary tax digest, the City of Dalton Mayor and Council studied keeping the millage rate the same. The City held two public hearings on the tax increase on November 5th. After further consideration, City leaders have canceled the third public hearing on the tax increase which was scheduled for Tuesday night, November 12th, at 6:00 pm and will instead use that meeting to consider a vote to adopt the rollback rate.

Projections show that if the rollback rate is adopted, the City of Dalton will bring in $121,828 less in property tax revenue for 2024 than if the millage rate is kept the same as 2023.

Over the past 21 years, the City of Dalton has only had one property tax increase. If the the Mayor and Council adopt the rollback rate at Tuesday night's meeting, it will be the 11th time in the last 21 years that the City has adopted the full rollback millage rate. The Council reduced the millage rate below the rollback rate in 9 of the other 10 years during that period.